“This trick gives you advance intel on the stocks that Wall Street will aim the most cash at.” -Drew Day, former hedge-fund manager

“Early-Bird”

See the next stocks that Wall Street is about to pump $44 billion into…

Hello, and thanks for tuning in. I’m Brad Hoppmann, an algorithm developer and 35-year trading veteran. I’ve worked alongside America’s best stock analysts.

Today, I’m taking folks behind the scenes to show them Wall Street’s biggest secret… one that can easily be copied. It just might make some lucky viewers rich.

Could that be you?

Let’s find out. Take a look at this shocking research.

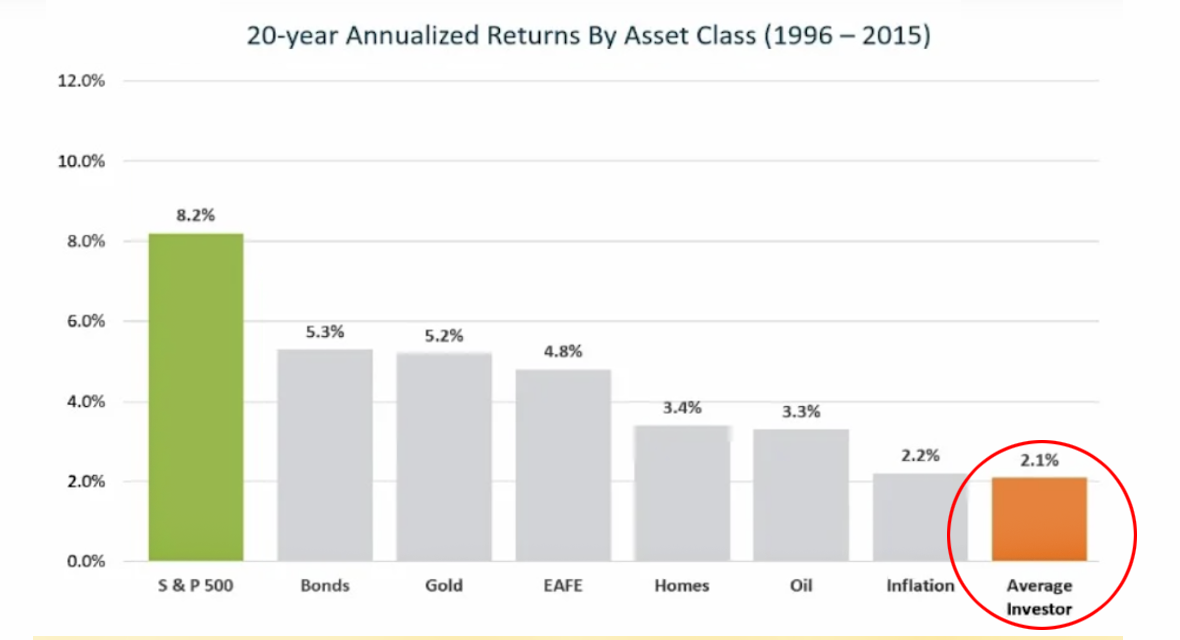

It’s a 20-year study that shows people who pick their own stocks, on average, have a portfolio return of +2.1%.

Sure, they might do great for a few years, but over time their losses burn up their savings.

Having worked alongside America’s most popular stock pickers, Like Jim Cramer and others, I can tell you that their stock selection was not based on sophisticated computational analysis. Instead, they selected stocks based on what they believe markets will do based on news events and future company results.

But Wall Street plays a different game.

They’re hunting folks like yourself.

They want to lure them into their trap. They’ve got the media under their thumb. So, they’re able to hype a particular stock through TV appearances, articles, social media influencers, and more.

Millions of investors get sold on the idea of that stock, then they pile into that stock.

Once Wall Street has them right where they want – they pull the trigger.

Ditching that stock.

And running away with bags of gold.

They win big.

Meanwhile, everyone else get the crumbs.

That’s why it’s time to modernize your investing. So, your savings aren’t a feeding trough for fat cat CEOs.

By tracking Wall Street’s trades like I do…

Normal traders could take a position in key stocks…

Before Wall Street completes their process of pumping millions or billions of dollars into them.

This intel could save one’s retirement, offering a completely new lifestyle.

Folks could be in front of Wall Street’s money tsunamis month after month.

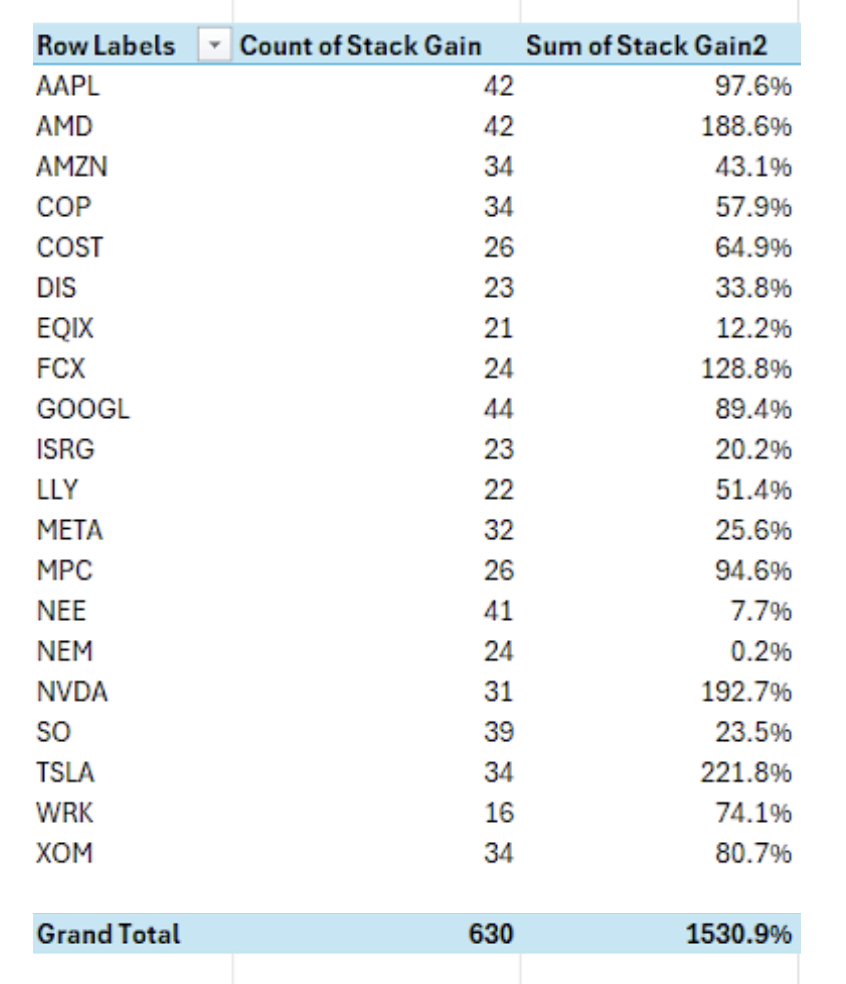

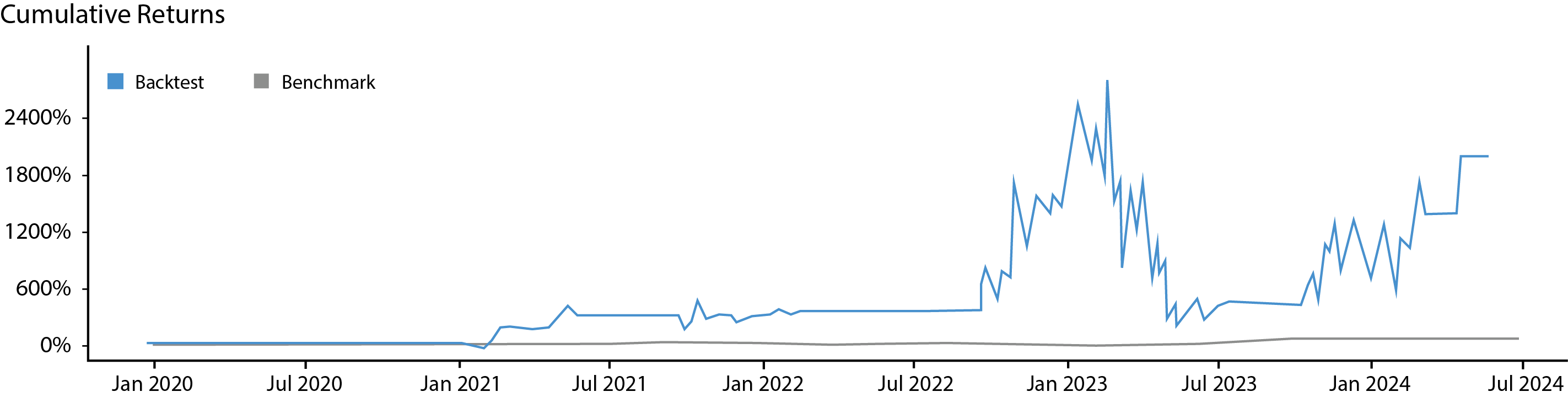

Based on five years of back tests, this smarter approach could give folks a stunning +1,530% portfolio return.

How’s it possible to make

15 times more money?

We simply copy Wall Street’s monthly money moves virtually in real-time.

I can see behind the scenes Wall Street’s activity. They don’t chase +1,000% gains. Instead, they execute high-probability trades on select stocks.

And boy does it stack the $100 bills tall and wide! For example, I could see all their money moves since 2019 on Advanced Micro Devices (AMD) stock. Here’s some of them:

That’s a lot of profits pouring in, just from this one stock.

It was a cash machine for them.

Something everyone can copy too.

Combined, the profits add up.

If you tally all the big moves I tracked on AMD, combined, folks could’ve made a +188.6% return.

On a $10,000 investment that would’ve yielded $28,800.

It would’ve turned every $25,000 into —

$72,000

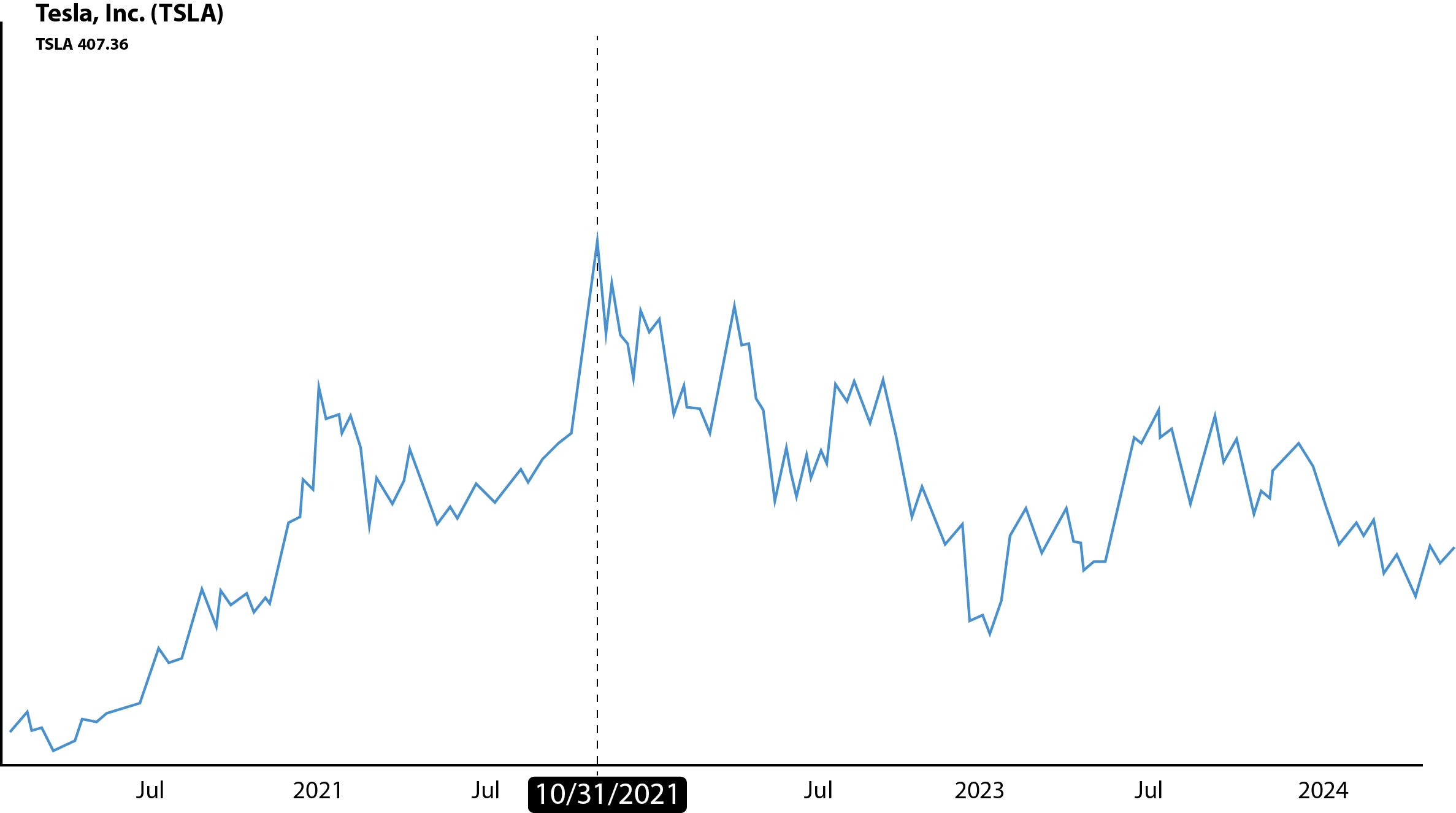

Look at Tesla’s (TSLA) stock chart. Over the past five years it nailed an incredible peak gain of +981%.

After the peak, Tesla’s share price collapsed. Investors who held on too long would have sunk in despair, watching their money vanish.

But if folks could see Wall Street’s activity like me… Tesla could’ve been a money machine for them. By handing them multiple payouts like these:

If folks could’ve seen and followed 33 of Wall Street’s big moves on Tesla since 2019, combined, they could’ve been up +221.8%.

This return could turn every $12,000 of theirs into —

$38,520

Wall Street picks their favorite stocks and like an ATM machine…

They take multiple withdrawals.

Now everyone can copy them!

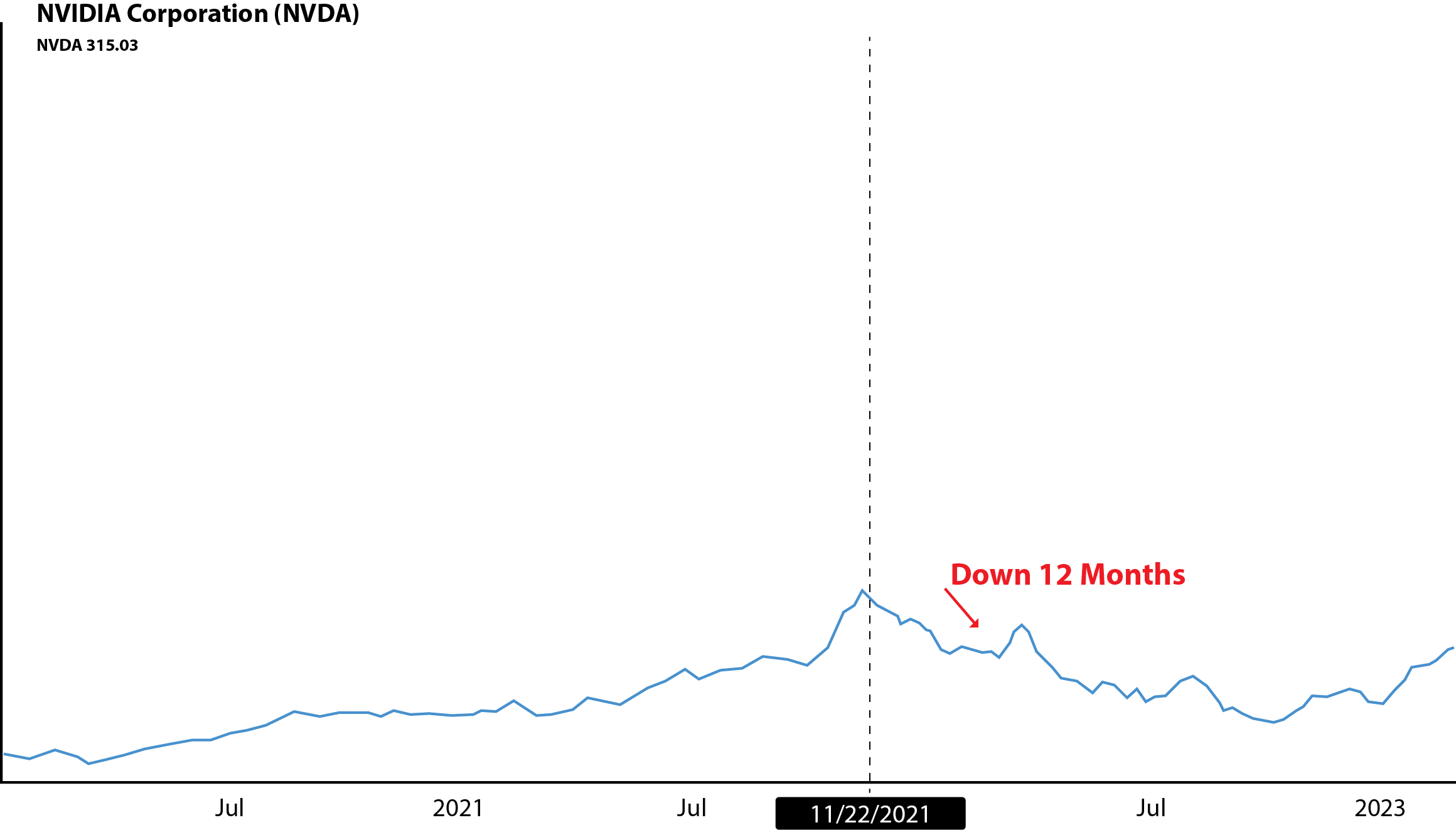

Recently, Nvidia (NVD) has been in the spotlight.

Nvidia had a peak gain of +415% on November 15, 2021. Many investors would’ve stayed in… hoping for the shares to continue rising. But Nvidia sank into the red for nearly 12 months afterward.

If folks knew Wall Street’s monthly moves, like me, they could’ve avoided those losses. By copying Wall Street’s activity on Nvidia stock, they could’ve taken multiple profits like these:

In all, I can see they placed 31 trades that line up perfectly. Copying Wall Street’s money moves on those trades, overall, you could’ve been up +192.7%.

If you noticed, I didn’t list a 2024 trade.

In a few minutes I’ll show you why. It’s a shocker.

Nvidia is synonymous with AI.

It’s just one of many AI stocks.

Recently, investors caught AI fever.

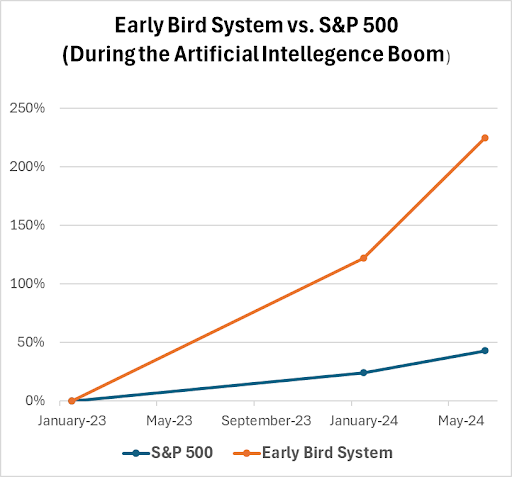

So did Wall Street. If one would’ve tried to follow stock analysts or their own educated guesses on AI stocks since January 2023…

The odds are that they’d have an average return of +43% based on available data. They’d hit it big on some AI stocks but the losers would’ve dragged them down.

However, if they saw Wall Street’s biggest AI stock buys and those they avoided, and copied their moves, they could’ve…

Made 4X more money on AI mania

Ok. So, how can I see Wall Street’s activity behind the scenes virtually in real time?

And how can folks stack up the profits like these starting immediately?

I have a way to see Wall Street’s activity behind the scenes legally.

That’s how I know which stocks they’re buying the most shares in.

If you average the money they allocate into stocks, every month, they go on a nearly…

$44 billion shopping spree

That means they’re pumping massive amounts of money into select stocks.

Think of them as tsunamis of money.

That roll across the stock market every month.

It would be ideal to hold the stocks that’ll be flooded by them.

They pick their stocks.

Investors can know where their money is going.

And take an “early-bird” position.

Their PR machine whirs into action.

Mainstream media and influencers pump out optimistic stories about that stock, claiming it’ll rip.

Then it’s monkey see, monkey do. Millions of retail investors and various firms stampede into the stock.

Share values skyrocket.

Once the stock’s price hits Wall Street’s exit target…

They sell their shares.

Walking away richer.

Now, everyone can too.

Without this intel…

Most investors are uncertain.

They wonder if the stock is momentarily dipping and if it’ll rally back.

Or if they should cut and run.

If you’re one of those investors, you just don’t know for sure.

Wall Street knows the answer BEFORE YOU

Because they’re influencing stocks and sectors.

Case in point:

Wall Street recently made a killing off Nvidia (NVDA) stock.

From the start of the year till this presentation, Nvidia surged +166%. The AI titan achieved a $2.2 trillion market cap, in just 96 days.

Compare that to Apple taking 718 days.

Nvidia was hyped on TV and financial publications to lure investors in.

Back in February, reports like this one on CNBC came out. Touting Nvidia as the cheapest, hottest chip stock to load up on.

Around the same time, Citadel, a hedge-fund, was on CNBC, hyping Nvidia to lure investors in…

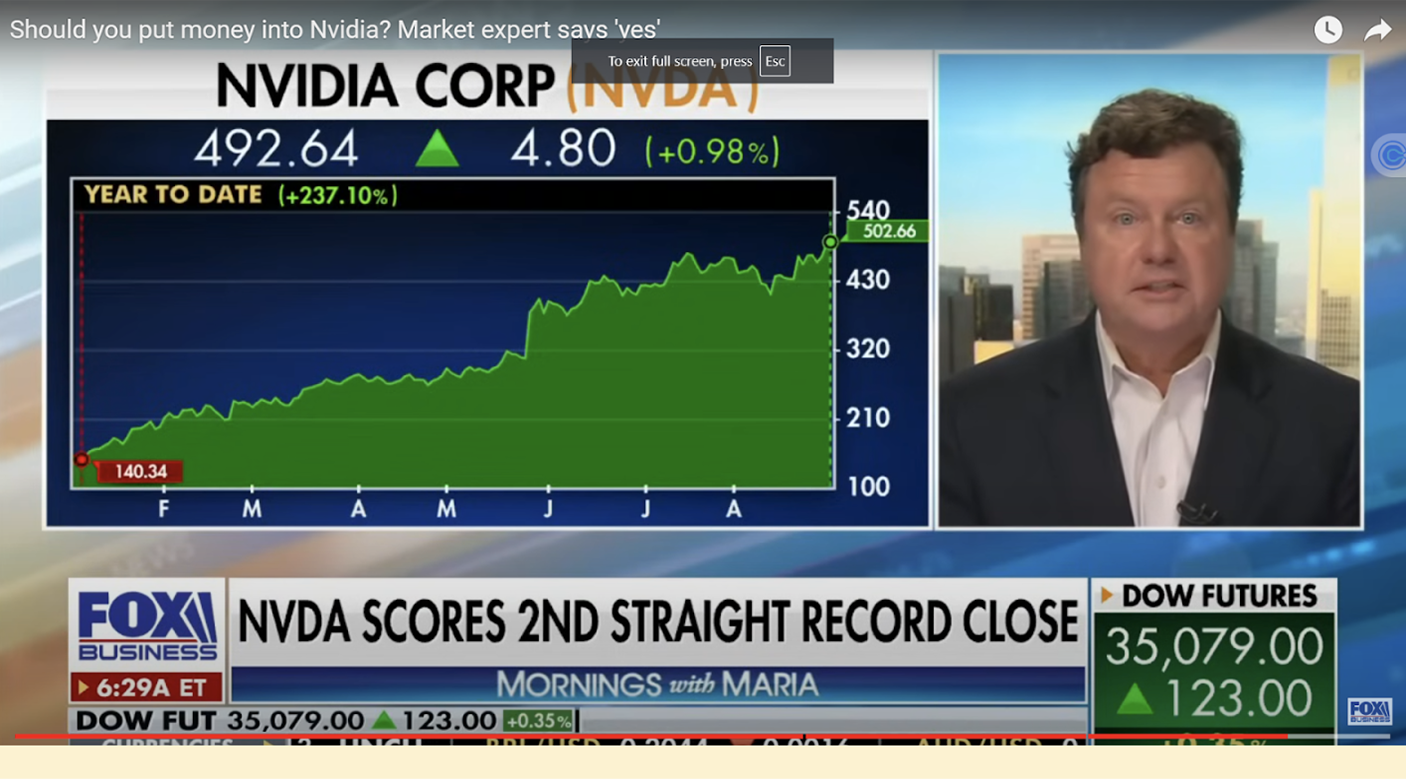

Fox Business, around the same time, had experts on TV urging investors to “Back up the Truck”…

Here’s another TV expert on Fox Business who urged investors to load up on Nvidia.

Wall Street hyped Nvidia stock on Yahoo Finance too. This story urged investors to pile in, calling Nvidia the “Best Idea for 2024.”

Around the same time, Fast Company ran this soft sales pitch to lure more investors into Nvidia stock.

Those are just a few of many media pieces to pump Nvidia stock.

Did they work?

Wall Street hit the bullseye.

Some commenters on Yahoo Finance, YouTube videos, and other commenting boards became so overtaken with Nvidia fever… they threw their entire life savings into the stock.

Believing it was their gold ticket.

Behind the scenes, it was time to go exotic car shopping for Wall Street. Millions of investors piled into Nvidia stock.

Fattening the share price.

Wall Street began incrementally exiting Nvidia stock, taking massive profits at the expense of unwitting investors.

I can tell you who some of them are.

One of them was Philippe Laffont of Coatue Management. He sold 2.9 million shares.

Ken Griffin of Citadel Advisors sold 2.4 million shares.

Israel Englander of Millenium Management cut loose 720,000 shares.

David Siegel of Two Sigma Investments dropped 420,801 shares.

And on and on it went.

While the public was distracted with Nvidia, the Smart Money was quietly shifting dollars into overlooked wall flower – Amazon (AMZN) stock.

Coatue Management picked up nearly a quarter of a million shares.

Citadel Advisors grabbed 352,453 Amazon shares.

Israel Englander planted his flag in 2.3 million Amazon shares.

Viking Global Investors pillaged 1.9 million shares.

And on it went.

That’s why folks are a sitting duck for Wall Street, giving slices of their retirement dollars to them, year after year.

That’s the bad news.

The good news is that folks can now protect their retirement. Like me, they can see Wall Street’s secret shopping list every month.

And copy their trades.

I’ll show you exactly how in this presentation

You’ll laugh at how easy it is

First, it needs to be said that these are not SEC 13F filings, which show what hedge funds and other institutions buy every quarter.

13F reports make for a nice article on Yahoo Finance or Barron’s, but it’s outdated information.

Knowing the stocks Wall Street will feed on like a shark frenzy every month…

Is possible through a publicly accessible algorithm I call:

“Early-Bird”

Don’t worry. You don’t have to know anything about algorithms to benefit.

This is beginner friendly.

Early-Bird does the heavy lifting. It informs in plain English when to buy and exit.

Just like it did with Marathon Petroleum Corporation (MPC). Going back to 2019, here are some of the trades folks could’ve copied:

That’s a lot of high-probability, short term trades that could’ve piled the profits… year-after-year.

Let’s look at how my Early-Bird algorithm could reduce your risk.

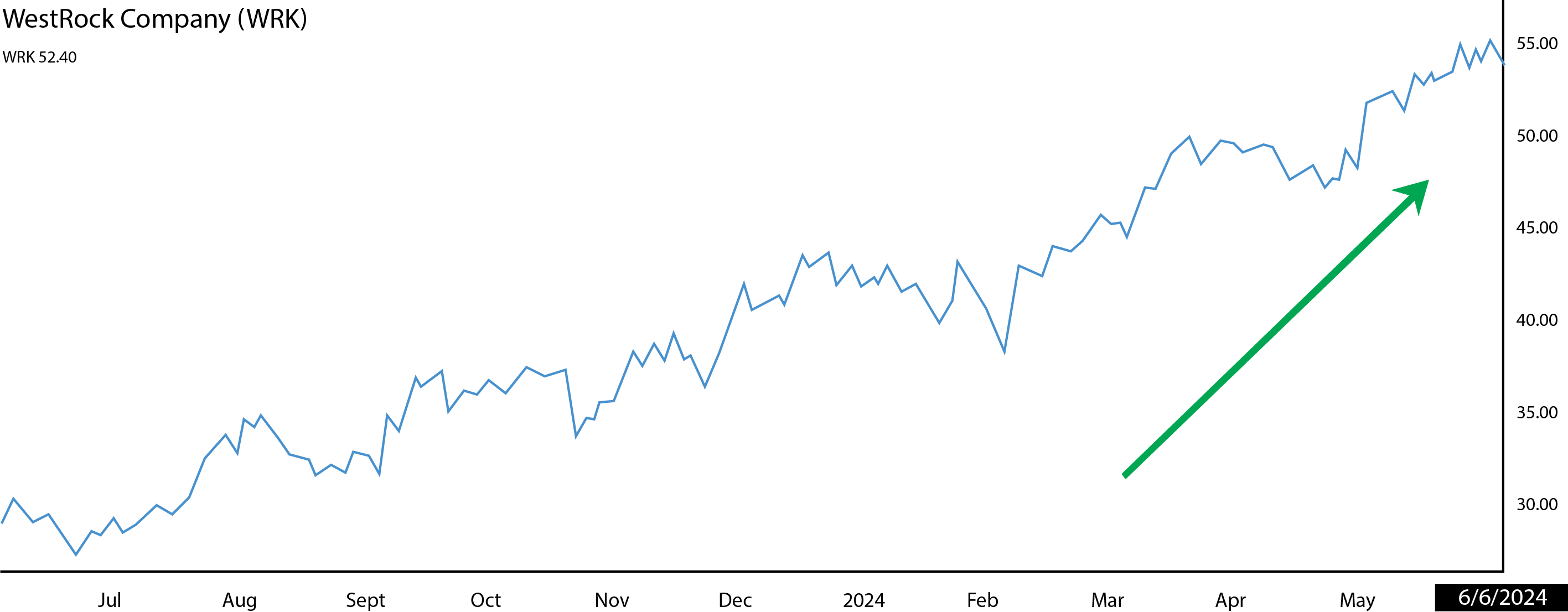

Here’s WestRock Company (WRK), a packaging solutions provider. It delivered a +66% gain in March 2021.

Then, this stock was in the red for two years. Over the past 12 months, though, it’s been up 83% as of this presentation.

For the individual investor, for most folks, it would’ve been stressful trying to figure out what to do over time on this stock.

They’ve got to look out for their own blood pressure.

The smarter, more relaxed way of doing this…

Would’ve been to let my algorithm show them how Wall Street played WestRock Company.

This stock pumped profits into Wall Street’s accounts, year-after-year.

Folks could’ve copied their moves to book gains like these:

Wall Street moves the markets.

They pick their stocks…

Then they turn them into cash machines.

They’re doing this on lots of stocks.

It’s like having multiple ATM machines they’re taking withdrawals from.

My algorithm tracks that activity.

It could set folks up with a lifestyle where they’re copying those moves.

Collecting profits 30 days… 60 days… or 90 days out on a bunch of stocks.

I think it’s better than dividend income.

A stream of income coming in like this could make life a lot sweeter.

Now, let’s zoom out for a moment.

Over this same period, from 2019 to the present, Early-Bird could’ve shown folks 19 stocks that Wall Street was aiming the most cash at.

If they placed the individual stock trades my algorithm tracks, their portfolio could’ve looked like this:

Folks could’ve had a dream portfolio, giving them this fantastic +1,530% return.

Are you starting to see how what you’re doing is riskier?

Do you want to keep leaving stacks of money for Wall Street to pocket?

It’s time to shift from vulnerable, primitive investing. And modernize.

Wall Street has deployed supercomputers, AI, and algorithms. Giving them advantages over most folks.

For example, Renaissance Technologies’ Medallion Fund nailed an average annual return of about +66% before fees.

If most people had an algorithm like that working for them…

It could turn their $10,000 over five years –

Into $126,049!

Hold seven years, and they’d have a whopping $337,341.

Unfortunately, they can’t join that fund. It’s only available to employees and family members.

Chances are, like most people, many don’t have the qualifications to be accepted into these elite hedge-funds either.

That doesn’t matter.

My “Early-Bird” algorithm is available to real folks and off limits to Wall Street. Early-Bird acts like a spy.

Tracking the buy orders of

1,000 Wall Street firms like Goldman Sachs, BlackRock, and Citadel…

Which has delivered annualized returns of about 19% since its inception in 1990.

Or Seth Klarman’s Baupost Group which generated average annual returns of about 20% since 1982.

Uncovering the stocks that Wall Street is aiming the most cash at isn’t easy.

If a hedge fund like Baupost Group believes Netflix (NFLX) is about to lift off…

They don’t do a massive buy order in one go.

None of these Smart Money players do.

Instead, they buy in batches, which happens across weeks or months.

Till they acquire all the shares for that trade.

Some stocks have a lot of trading volume, like Apple (AAPL), which might see 26 million shares change hands in a single day.

Other stocks like Marriott International (MAR) have an average daily volume of 1.4 million.

So, the size and rate of purchases will be different depending on the goal of that trade.

That’s why Wall Street uses algorithms to sniff out how many shares they can grab without attracting attention.

Human eyes can’t spot this

The Early-Bird algorithm shows how and when this money moves even when Wall Street tries to cover its tracks.

There are several reasons why hedge funds don’t buy at once.

One reason is that they don’t want to file a Schedule 13D or 13J with the SEC, which discloses their actions.

Filing it could attract unwanted market attention from competitors.

It could create increased volatility that fouls up their plan for a particular trade.

For example, if a competitor catches on, it could prompt them to load up too and drive up the share price too fast.

Buying too much of a stock at once could also trigger regulatory scrutiny and delays in completing their share purchases.

Sometimes the Board of Directors of a company may not want a certain firm buying too many shares of their stock.

They might try to throw a monkey wrench

into that plan

Another reason why Smart Money doesn’t buy too many shares too fast, is because…

They may have internal risk management policies that limit the amount of shares they can own of that stock at once.

All said, it’s a ton of data, from nearly 1,000 firms, intentionally trying to hide their biggest acquisitions.

That’s where my Early-Bird algorithm comes in.

It spies out that data, decodes it, and gives clear buy and sell alerts.

It could show folks how to get into a stock position before Wall Street completes their buy batches.

Sitting safely in that position before millions of retail investors stampede into that stock.

In a moment, I’ll show viewers how beginner-friendly this is…

Plus, how to get Wall Street’s secret MONTHLY shopping list to get in front of their money tsunamis.

First, please allow me to introduce myself properly

As I said, my name is Brad Hoppmann. I am the Head Trader at Predictive Press, an innovative division of Trading Logic partnered with Trading Logic and Base Camp Trading to help traders make money. My group focuses on algorithmic and technical trading using helpful math concepts like statistics, moving averages, predictive analytics, AI, and Machine learning.

I graduated from the University of Florida with a degree in Strategic Business Management, specializing in Decision & Information Sciences.

My master’s in business also included coursework in Decision & Information Sciences, specializing in Quantitative Methods.

The very university where Nvidia has a major $70 million AI partnership. In fact, my coursework had a focus on Machine Learning and Artificial intelligence (A.I.)

Since then, I’ve spent 28 years studying Statistics, Finance, Artificial Intelligence, algorithms, and predictive analytics.

I’ve been investing in the markets for 35 years, since age 16.

It’s possible you’ve seen my name before, as I’ve worked with the best stock analysts and research firms in America. Some of them include Jim Cramer, host of Mad Money, CNBC’s most watched show…

Including Louis Navellier, InvestorPlaces flagship expert who runs a $5 billion mutual fund.

Steve Sjuggerud who was a hedge-fund trader and published the leading publication, Daily Wealth.

And Dr. Martin Weiss who built a bank, stock, crypto and insurance rating agency and spoke before Congress on economic matters.

I’ve worked at an options trading firm that was eventually sold to Ally Bank, one of the 20 largest banks in America.

Over the years, I think I’ve learned a thing or two about trading.

Last year alone, I’ve paid over $100,000 in trade commissions alone

That’s a ton of trades.

But staying plugged into the markets and constantly back-testing my strategies in every situation we have seen in the last decide has led me to some of the highest-performing strategies I have seen anywhere.

You can see my “early bird” system surged from just $1,000 in 2019 to over $477,022, at the time of this presentation.

That’s a mind-blowing

+47,602% return!

I’ve been able to read the tea leaves for the markets, too.

In 2008, I predicted the 2008 stock market crash and banking crisis. To profit from it, I shorted it by buying puts on Lehman Brothers, Goldman Sachs, and other banks.

Turning about $5,000 into over $150,000 in a few months.

If it weren’t for the bailout, I could’ve made over half a million dollars on that $5,000.

Along with trading, I’ve built algorithms, trading systems, product strategies, and AI applications for employers and clients.

Naturally, Wall Street tried to snag me. In fact I worked on Wall Street for a few years, working with a few legends in our space like Jim Cramer and Doug Kass.

The prospects of a job there was exciting.

But after a lot of introspection and kissing a bunch of frogs, I realized it just wasn’t for me.

The values.

The lifestyle. It didn’t suit my family first approach.

I noticed that the rabid pursuit of the dollar often costs their families, and many end in divorce.

Making enough in a bonus to buy a Ferrari with cash… winning at the expense of mom-and-pop investors just wasn’t right.

So, I charted my own path, spending years developing my systems and then starting Predictive Press, an algorithm-focused publishing firm.

I kept my focus on helping regular folks with their retirement dreams.

That’s why I’ve put years into fine-tuning Early-Bird. Now it’s available to you.

Now you might be wondering…

How does this algorithm work during Black Swan events… corrections… recessions… and during geopolitical scenarios?

These are dangerous times when investors could lose a lot of money.

If you’re up there in age or you have a small nest egg… you can’t take chances.

You can lower your risk by following where Wall Street will place their money every 30 days.

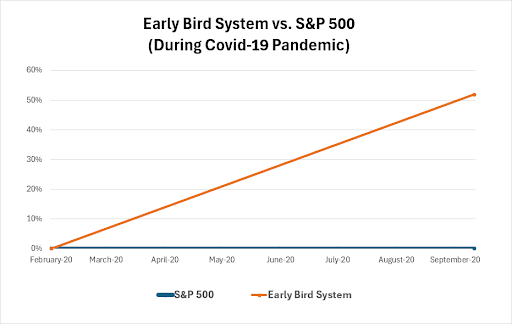

Backtests of my algorithm show that during the Covid-19 Pandemic, while most folks lost their shirts… my algorithm could’ve helped them to a —

+52% return!

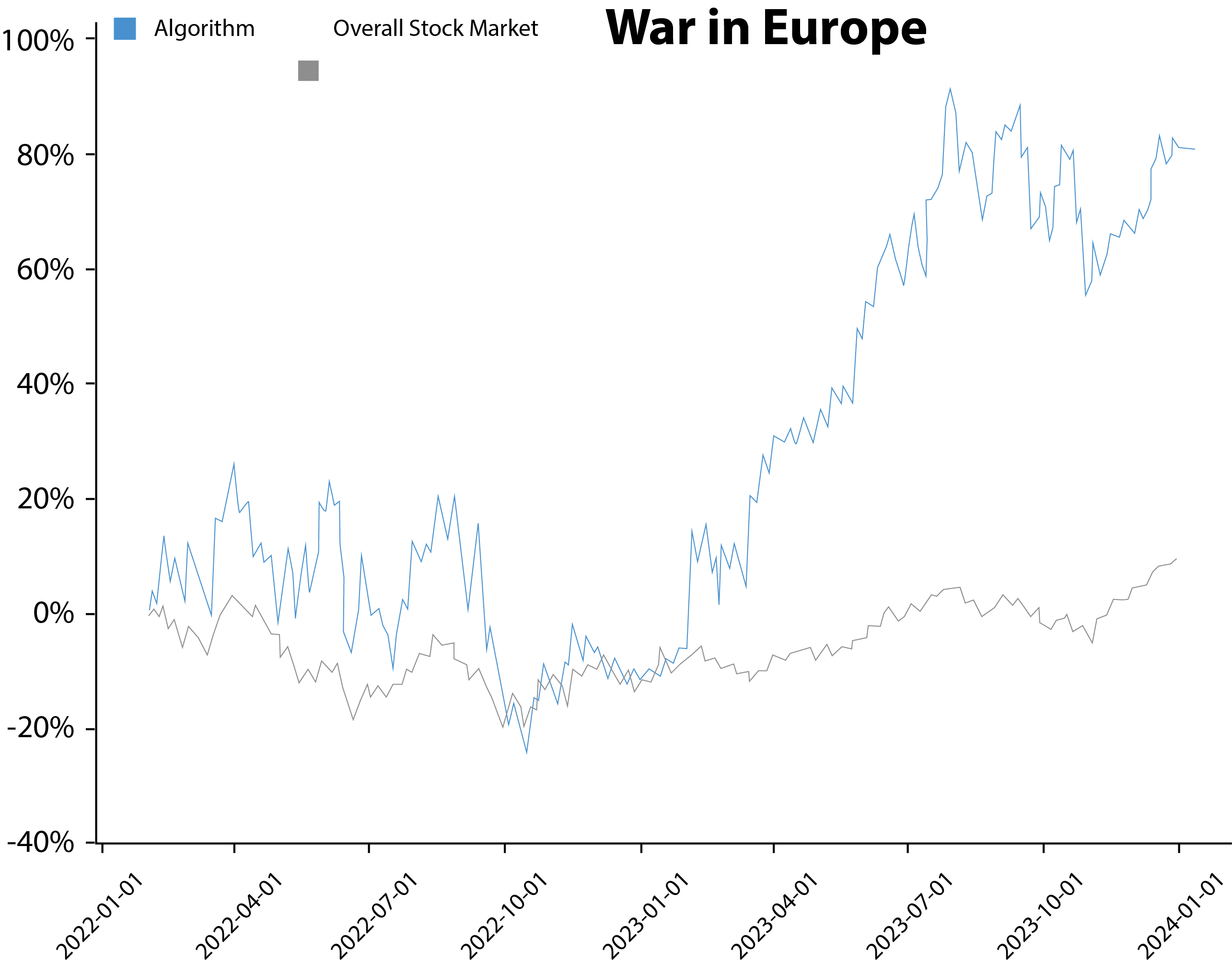

Russia’s invasion of Ukraine rattled investors. But Early-Bird could’ve helped folks make nearly…

EIGHT times more money!

Imagine having an all-weather solution.

It’s here waiting for you.

Here’s something else.

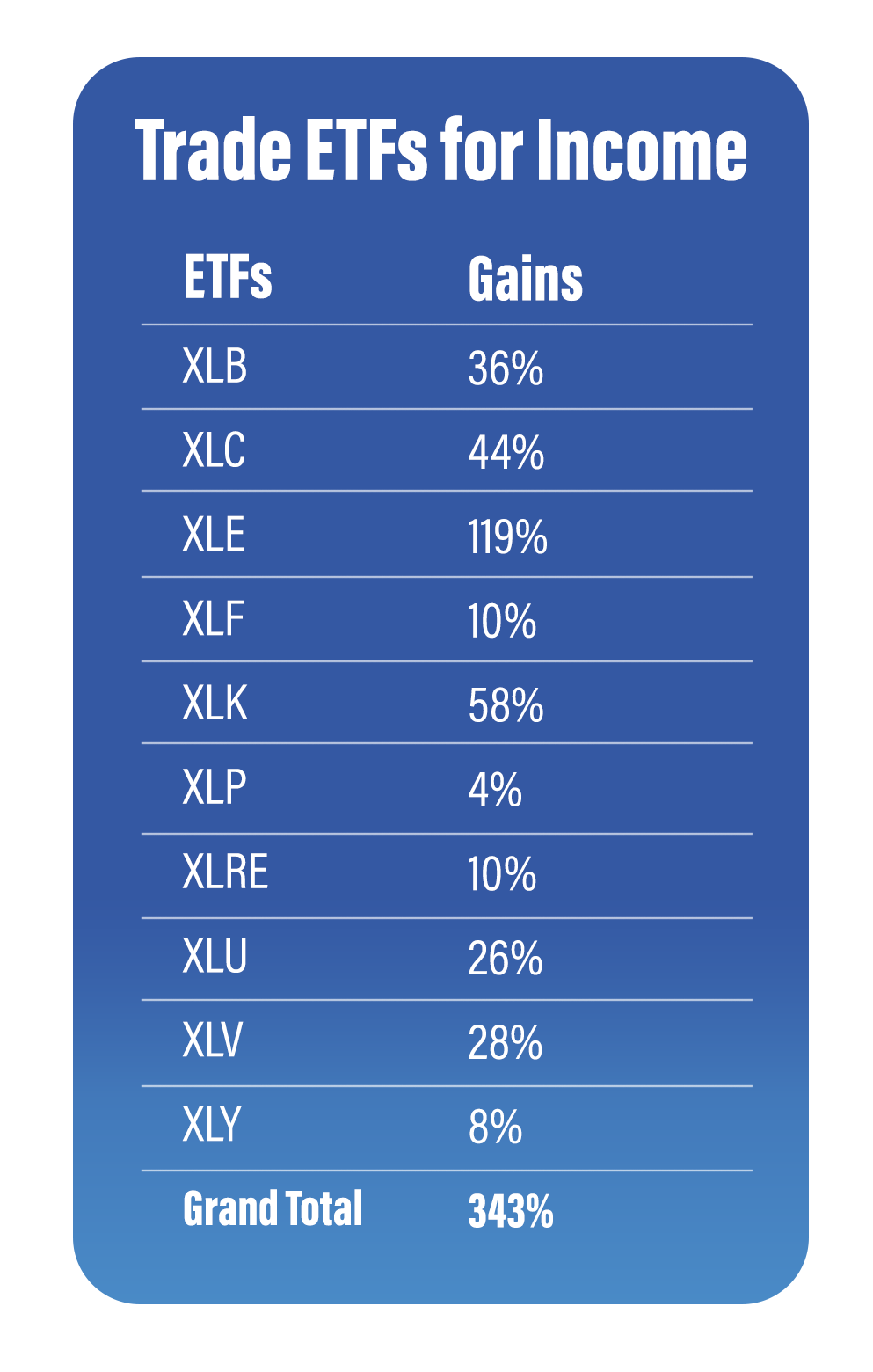

Not only can my algorithm show folks what stocks are on Wall Street’s shopping list…

It shows them what stock sectors benefit most from their monthly buying sprees.

In case you didn’t know, there are 11 stock sectors, including tech, utilities, energy, real estate, healthcare, financials, and so on.

Folks could earn money trading ETFs…

That represents each of these stock sectors.

How does it work?

Without going too deep into the weeds…

My algorithm picks the top two sectors based on the previous month’s money moving in and out of each.

It then predicts where money is moving based on the velocity of the moves.

Imagine more than TRIPLING

your money in 30 days

Nobody can promise that’s possible all of the time.

And you should never invest more than you’re willing to risk.

However, my algorithm has a +65% win rate and an average gain of +4.3% per ETF trade to date.

Here’s something else that’s incredible.

A lot of investors like to go heavy on tech stocks.

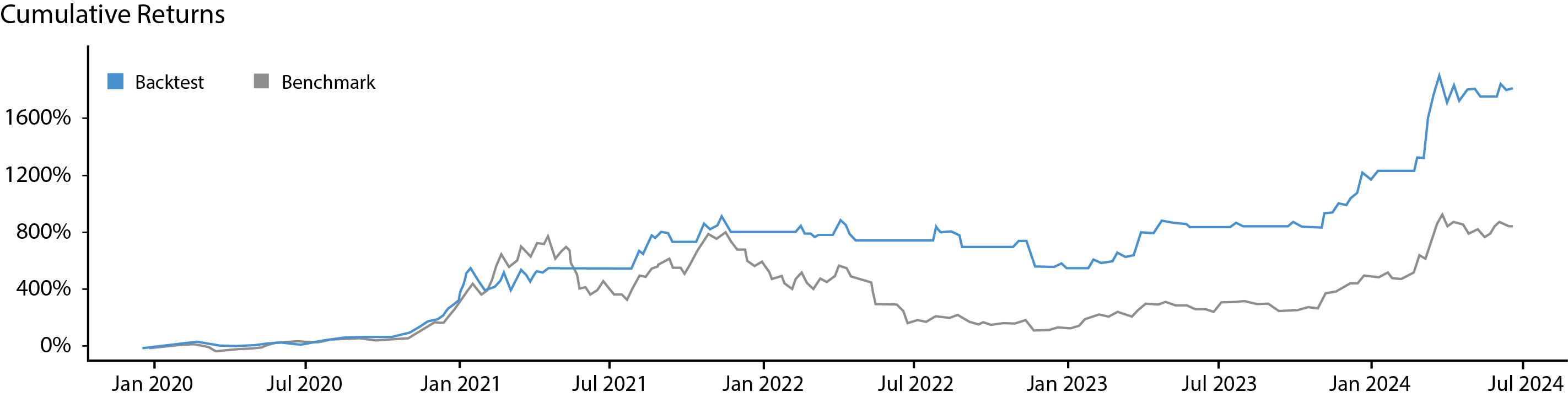

Since 2020, the Nasdaq could’ve given folks an +85% return. But my algorithm’s ETF tech trades could’ve outshined it –

Giving them a smoking +610% gain!

So, that’s a way to make money trading ETFs for corresponding stock sectors.

Here’s another way to fatten one’s wallet by using Early-Bird’s intel…

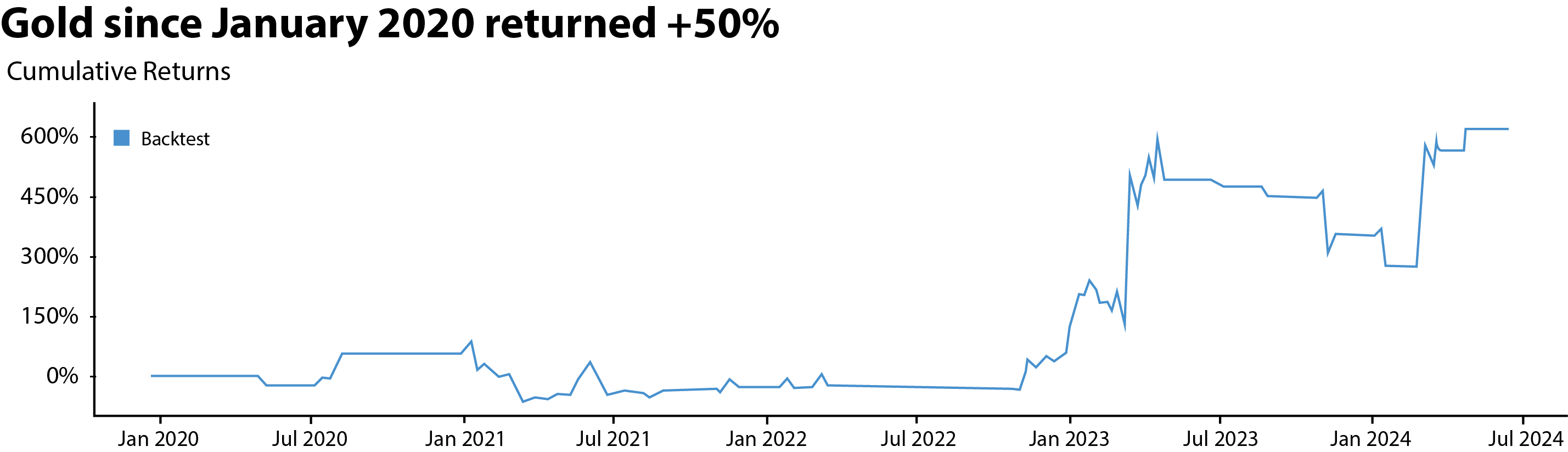

The Smart Money also trades commodities like gold, silver, natural gas, aluminum, corn, and more.

Now you can too.

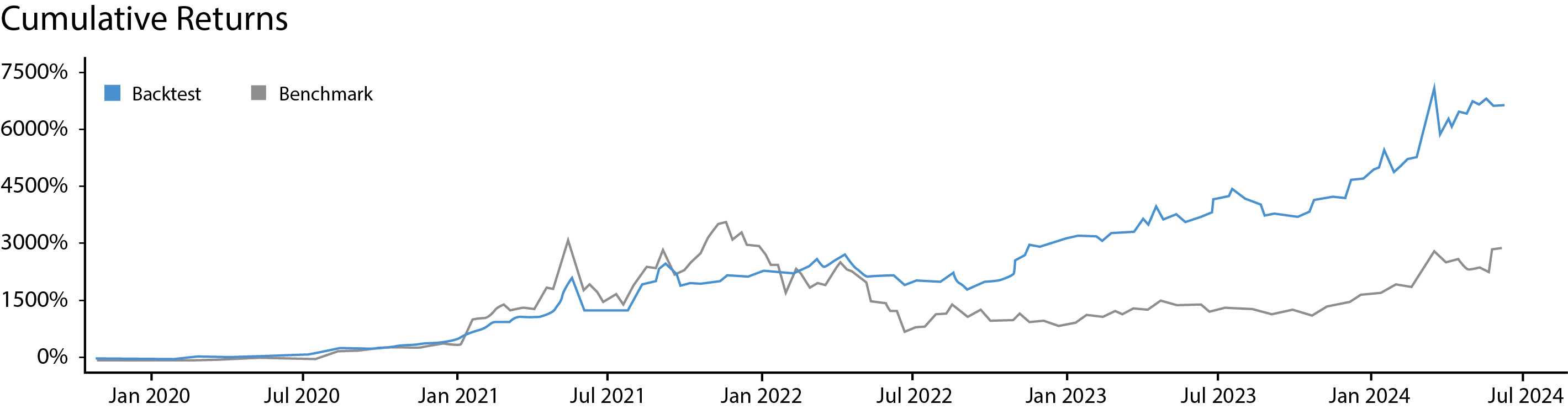

Using my Early-Bird algorithm, folks could’ve made a +600% return.

A small $10,000 investment could’ve added $70,000 to their account just this year.

Copper’s another hot commodity to trade.

Over the past four years, trading copper could’ve returned +62%.

But with my algorithm, knowing the right entries and exits, investors could’ve made 18 times their money.

Turning every $12,000 invested into a potential

$216,00 windfall

$25,000 in this trade could’ve meant a spectacular $450,000.

Recently, the SEC approved cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) for ETF funds.

Crypto has been in a bull market for some time now.

Bitcoin is the best-performing asset for eight out of the past 11 years.

Over the past four years, folks could’ve been up +800% on Bitcoin.

But with my algorithm, they could’ve trounced that!

To collect a +1,600% gain

Let’s look at the next most popular crypto that all the whales are piling into – Ethereum.

Ethereum is up +103% over the past 12 months.

Now, look at Ethereum’s performance since January 2020. Holding it since then, they’d be up about +3,000%.

However, with Early-Bird’s insight, their return would’ve shot for the stars.

Giving folks 65 times their money

Just $12,000 staked in this trade could’ve made them $780,000!

That’s an extraordinary return, for sure.

Nobody can promise it’ll happen again in the future.

But the point is, you don’t have to sit on the sidelines of crypto and miss out.

Early Bird gives folks multiple avenues to make money.

They could pluck profits from stocks…

ETFs…

And make piles of cash trading commodities and crypto.

Better than any stock picker long term.

No matter how good his track record.

Why?

That’s because he’s simply making educated guesses.

As a human being, he’s limited.

He’s limited by what information he has access to.

My AI-powered algorithm follows over 1,000

Wall Street firms by picking up mass money movements. Virtually in real-time

No stock picker can do that

My system can make millions of calculations in a single second. No man’s mind can do that.

A stock picker is limited by his bias, by fatigue, time constraints, and error.

My algorithm works 24/7.

Doesn’t suffer hangovers, doesn’t need a vacation, or time with the family.

It’s not biased by political, social views or any human bias.

Math doesn’t lie.

Doesn’t get confused.

That’s why taking stock recommendations from stock picking gurus and old-school newsletters is primitive investing… compared those of us who are building algorithms and AI to help do the work 24/7.

So, how does Early-Bird work?

And how could it give folks Wall Street’s secret shopping list every single month?

My algorithm receives information from the New York Stock Exchange, the S&P 500, the Nasdaq, commodity futures markets and most of the major crypto exchanges.

It’s millions of data points of what was bought, sold, and so on.

My algorithm decodes that information.

To show which stocks and stock sectors are targeted by Wall Street.

Almost in real time.

What I discovered is that on the last trading day of the month, that’s when Wall Street goes into a buying frenzy.

And often dumps their massive positions. Opening up huge opportunities for the regular investors like you and me.

My algorithm then integrates artificial intelligence to identify the best time to exit to take profits.

But this isn’t an ordinary program.

Mine’s designed to grow smarter

And more accurate.

To cut your risk exposure.

And maximize your profit potential.

Machine learning helps my algorithm improve its decision-making.

It examines historical price changes, volume changes, volatility, market conditions, recent returns, and how to improve stop losses, conditional exits, and more.

Altogether, this is something no human stock picker can do.

I hope you can see the exciting possibilities here.

Going from error-prone primitive stock picking…

To algorithms and AI.

Even if you don’t know squat about them.

You could begin making bigger, more consistent PILES OF CASH…

Knowing Wall Street’s confidential shopping list before millions of folks.

That’s the power of algorithms, Wall Street grows richer from them.

You could too.

But my algorithm isn’t for them.

I don’t fit in with that crowd.

Helping an elitist CEO pay for his wife’s new lips…

Or buy his spoiled kid a Lambo doesn’t sit well with me…

Meanwhile, regular folks who worked hard all their lives fall behind.

I see it all around me. Folks disillusioned with their investments.

With the system.

Wondering why the stock they bought, which has a great earnings report, goes nowhere.

While a stock that had a lackluster earnings report sees its share price fly for seemingly no reason.

Folks feel like we’re living in a world where 1 + 1 doesn’t equal two anymore.

They’re right.

That’s why my mission is to help real people.

That means you.

I’ve packed my algorithm into a monthly advisory called TradeSmart.

Where everything is simple enough that even an Iowa pig farmer could benefit.

While a service like this should be expensive since it could make some lucky people millionaires, it doesn’t make sense for me to charge an arm and a leg.

I want to democratize AI and algorithms so everyone can benefit.

Today, I’m practically giving it away —

At the best bargain possible

TradeSmart is the only advisory on this side of Wall Street, to my knowledge…

That gives folks the results of pure algorithm plays instead of old school stock picking.

Free of human bias and desperate guesses.

Accept this special offer to join TradeSmart today, and you’ll get the following:

⬛ Early-Bird Stock and ETF Plays:

Every month I’ll give you three stocks or ETF ideas that my algorithm shows are in the path of a Wall Street cash tsunami. It’s possible to collect potential payouts in 30 days or so on some of these plays.

⬛ Early-Bird Commodity Plays:

Besides stocks, commodities could be a jackpot. My algorithm can spy out whether gold, silver, currencies, grain, energy, and more, is about to see a buying frenzy. You’ll get up to three commodity plays every month.

⬛ Early-Bird Crypto Plays:

There’s a ton of volatility in crypto, it’s a trader’s paradise. Cryptos like Ethereum over the past five years delivered fantastic gains as high as +1,385%. The SEC just approved Ethereum for spot ETF funds. My algorithm surveys crypto data, shows what the whales are hunting, and issues trades on both coins themselves and crypto ETFs.

In total, you’ll get:

5 to 10 Trade Recommendations Every Month

Weekly Trading Videos:

Every week you’ll get market recaps, and what the algorithms see playing out over the next seven days.

Monthly Reports:

Every month we’ll meet in a LIVE trading room where I’ll give commentary on market shifts, review trade charts and discuss what my algorithm shows is coming down the pike.

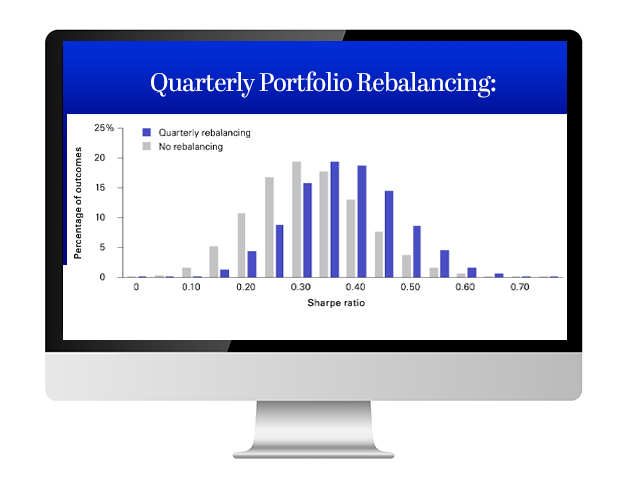

Quarterly Portfolio Rebalancing:

Also, every 90 days we’ll meet in the LIVE trading room where I’ll show how to rebalance your portfolio to diversify and lower your risk of being too heavily weighted in any one position or asset class.

Immediate Trade Alerts:

You’ll also get instant Trade Alerts by email if one of our plays needs immediate action.

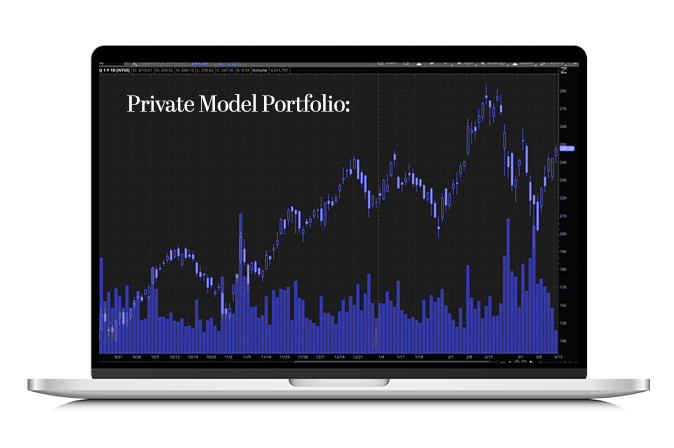

Private Model Portfolio:

Membership also gives you access to our model portfolio that lists all positions and how they’re performing.

Concierge Customer Support:

If you have questions about your membership, feel free to call or email our friendly Raleigh, North Carolina based Customer Care team.

This is white glove service all the way.

Where you’ll get 5 to 10 “Early-Bird” trade recommendations every single month.

Plus, I’ll show you the exact time to collect profits from our trades.

Powered by my AI and algorithm available only in my TradeSmart advisory.

This incredible intel gives you a fighting chance against Wall Street’s sketchy activities.

It’s a ton of value with a retail price tag of $119.

While it’s a steal…

You won’t pay that.

Or even half.

Times are tough for many. People need a helping hand.

Today, I’m giving you a —

60% off discount!

Claim this discount against the retail price.

And get a quarterly subscription of TradeSmart for just $47!

You could know the stocks Wall Street is aiming the most cash at.

And get the early-bird advantage!

The people at the top rigged the system in their favor.

At your expense.

They’re using AI to run circles around you in the markets.

And they’re using AI to lay people off.

This is my way of helping you fight back.

Algorithms have provided an amazing life for me and my family.

So I don’t need to charge an arm and a leg.

However, I can’t maintain huge discounts like this forever.

There are a ton of expenses that go into running an advisory like this.

Office rent. Computers. Websites, Data Storage. Tech support. Software. Payroll. Taxes. And more.

We must charge enough to cover these costs and incentivize our team to stay with us.

By having the best team and software to run my algorithms, analysis, and AI… That’s how we deliver 5-star performance for TradeSmart members.

By demonstrating exceeding value and excellence, it’ll motivate members to stick with us for the long haul.

Repeat business is how we can power our business and pay for the best data and research.

Where everyone wins.

I’m confident once you try TradeSmart, you’ll realize having this algorithm show you Wall Street’s top stock picks… is the sanest way to get your dollars busy birthing new dollars.

So, you could secure your retirement once and for all.

I understand you haven’t met me personally, that’s why I want to give you a hands-on look at what TradeSmart offers.

To sweeten this offer…

You can try TradeSmart

RISK-FREE FOR 60 DAYS!

That’s right.

Take up to 60 days to see if these algorithm trade recommendations beat what you’re doing now.

During this time, you’ll get up to 20 trade recommendations.

Many of these trades close out in about 30 days.

If you don’t believe this could make you fistfuls of cash, while reducing your downside… then you owe nothing.

Simply let our Raleigh, North Carolina Customer Care Team know within 60 days of purchase…

That you want a refund. By emailing or calling (919) 935-0010.

You’re entitled to that.

And we’ll give you 100% of your money back. Fast. And easy.

We’ll part as friends.

However, I understand TradeSmart may not be right for everyone.

There’s lots of people who like to gamble.

Or think they’re natural stock pickers.

Then there are those gray-sky folks who’re more comfortable struggling and doing things the hard way.

If that’s you, then please don’t waste anyone’s time joining TradeSmart.

TradeSmart is ONLY for folks who want to modernize their investment approach.

Who want to do things the smart way.

Focusing on safer, higher probability plays.

That could help folks retire early.

Secure your remaining retirement.

And build true wealth.

Just remember that all investments carry risk. You should never risk more than what you’re willing to lose.

One last thought.

Look over your life, you toiled. Had to negotiate purchases with loved ones. Made sacrifices. Things weren’t always easy.

It’s time to take care of yourself.

By joining today…

The next 3 months could put you

in life’s sweet spot

Imagine going forward and having less stress on your heart. Less of a burden to carry around.

Sleeping more peacefully.

Feeling secure that a system is there looking at the markets day and night.

And more opportunities to live life how you want and finally do the things you always wanted!

That’s my goal– sunnier days could be ahead.

Together, we’re moving toward that!

It starts with this special savings.

At the best discount possible

60% off!

This special offer expires shortly.

So, if you’re ready to be in the stocks that’ll surge from Wall Street’s money tsunamis…

Then click the “Join now” button. It takes you to a Secure Order Form, where you can review everything once more before submitting your order, which will immediately give you access to everything I’ve described here.

This is Brad Hoppmann signing off. Thanks for joining me.